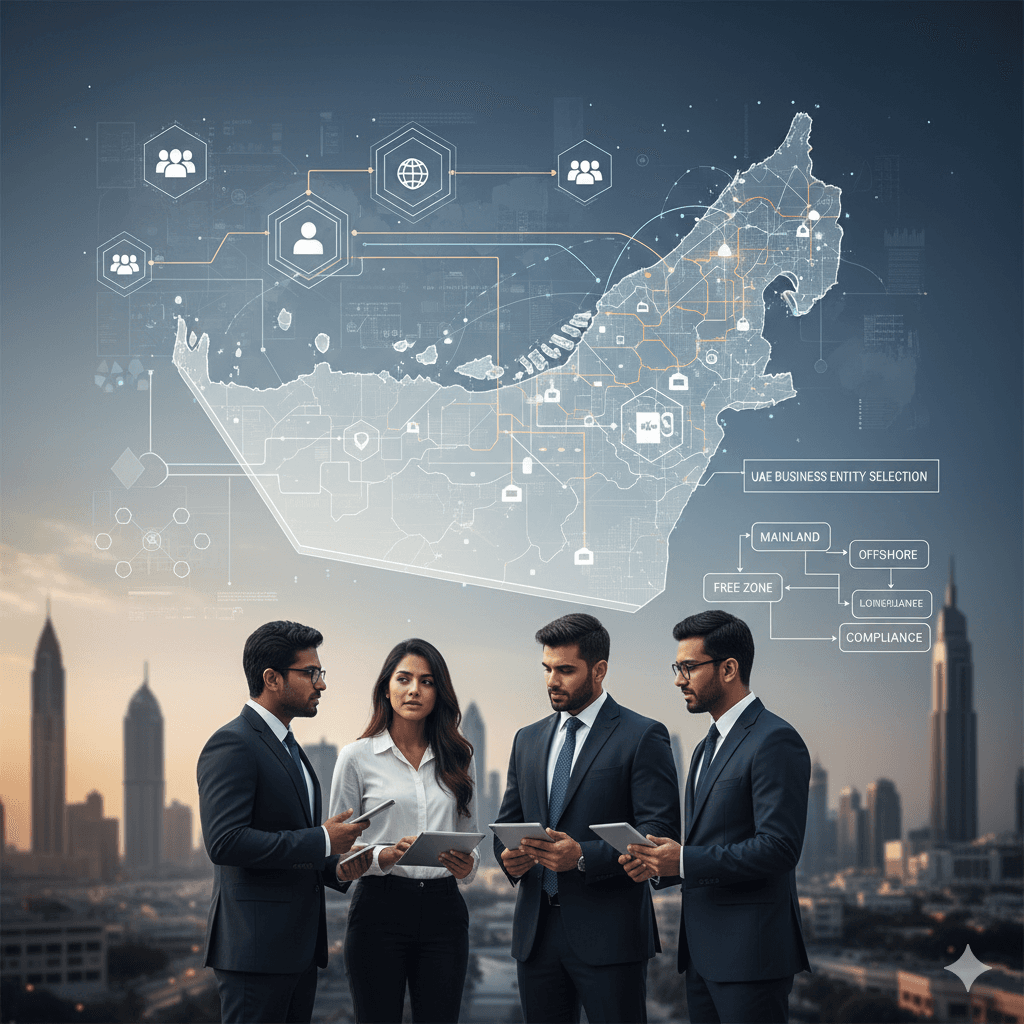

Mastering UAE Business Structuring: Choosing the Right Entity for Long-Term Growth

For international investors, the UAE offers a landscape of unparalleled opportunity. However, the first and most critical hurdle is determining the correct legal structure. Selecting the wrong entity type can lead to operational limitations, higher tax liabilities, and difficulties in future scaling.

Mainland vs. Free Zone: The Core Dilemma

The primary choice remains between a Mainland (Onshore) license and a Free Zone setup. While Free Zones were traditionally preferred for 100% foreign ownership, recent changes to the UAE Commercial Companies Law now allow 100% ownership on the Mainland for most commercial activities.

- ✓Mainland: Unrestricted trade across the UAE and eligibility for govt. contracts.

- ✓Free Zone: 100% import/export tax exemptions and industry-specific ecosystems.

- ✓Offshore: Ideal for asset protection and holding companies, but restricted from local operations.

“Strategy without the right structure is just a plan without a foundation. Your legal entity is the bedrock of your UAE success.”

— Nexusgate Advisory Team

Strategic Considerations for 2024

Investors must now account for Corporate Tax implications and Economic Substance Regulations (ESR). A well-structured entity is not just about the license; it is about ensuring your corporate governance meets global standards while maintaining local agility.